Get In Touch

California Accounting would be pleased to get in touch to discuss your accounting and tax needs.

06/15/2022

The IRS announced a revision to the standard mileage rates for computing deductible costs of operating an automobile for business, medical or moving expenses. This modification results from recent increases in the price of fuel. The revision increases the rate for business, medical and moving expense by 4 cents per mile and is effective July 1, 2022. The revised standard mileage rates are:

Business – 62.5 cents per mile

Medical and moving – 22 cents per mile

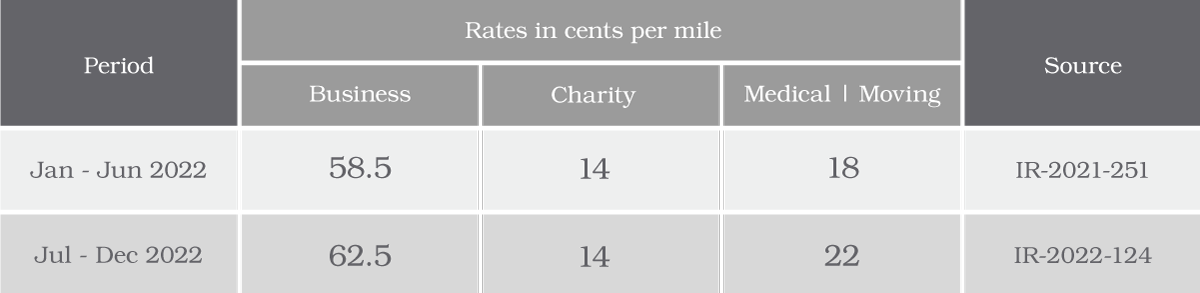

The following table summarizes the optional standard mileage rates for employees, self- employed individuals, or other taxpayers to use in computing the deductible costs of operating an automobile for business, charitable, medical, or moving expenses.

For travel from Jan. 1 through June 30, 2022, taxpayers should use the rates set forth in Notice 2022-03, and from July1, 2022 through December 31, 2022, taxpayers should use the rates set forth in Announcement 2022-13.

The standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile. The rate for medical and moving purposes is based on the variable costs.

It is important to note that under the Tax Cuts and Jobs Act, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. Taxpayers also cannot claim a deduction for moving expenses, unless they are members of the Armed Forces on active duty moving under orders to a permanent change of station. For more details see Moving Expenses for Members of the Armed Forces.

Taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates.

Taxpayers can use the standard mileage rate but must opt to use it in the first year the car is available for business use. Then, in later years, they can choose either the standard mileage rate or actual expenses. Leased vehicles must use the standard mileage rate method for the entire lease period (including renewals) if the standard mileage rate is chosen.

https://www.irs.gov/tax-professionals/standard-mileage-rates

https://www.irs.gov/newsroom/irs-issues-standard-mileage-rates-for-2022

https://www.irs.gov/pub/irs-drop/a-22-13.pdf

https://www.irs.gov/newsroom/irs-increases-mileage-rate-for-remainder-of-2022#:~:text=For%20the%20final%206%20months%20of%202022%2C%20the%20standard%20mileage,the%20start%20of%20the%20year

California Accounting would be pleased to get in touch to discuss your accounting and tax needs.

By submitting this form and signing up for texts, you consent to receive text messages from CaAccounting at the number provided. Msg data rates may apply. You can opt-out at any time.

Monday - Friday

9:00am - 5:00pm

Closed on Holidays