Get In Touch

California Accounting would be pleased to get in touch to discuss your accounting and tax needs.

12/30/2020

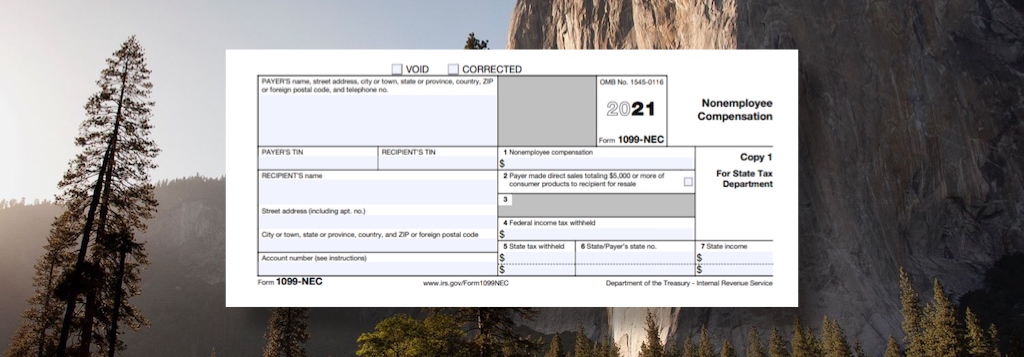

Form 1099-NEC (Nonemployee Compensation) is a new tax form that businesses will be required to file. Form 1099-NEC replaces Box 7 on Form 1099-MISC to report nonemployee compensation which reflects payments to nonemployee service providers and vendors. This change reflects only a change in reporting and not a change in the rules regarding payment filing requirements.

Starting in 2020, payments for services made in the course of a trade or business to US persons will be reported on Form 1099-NEC. Note that Form 1099-MISC still will report other payment types such as rent, other income, and royalties. However, the IRS has rearranged the box numbers for reporting certain income on Form 1099-MISC.

Business taxpayers must file a Form 1099-NEC form for nonemployee compensation if all four of these conditions are met:

California Accounting would be pleased to get in touch to discuss your accounting and tax needs.

By submitting this form and signing up for texts, you consent to receive text messages from CaAccounting at the number provided. Msg data rates may apply. You can opt-out at any time.

Monday - Friday

9:00am - 5:00pm

Closed on Holidays