Get In Touch

California Accounting would be pleased to get in touch to discuss your accounting and tax needs.

01/27/2020

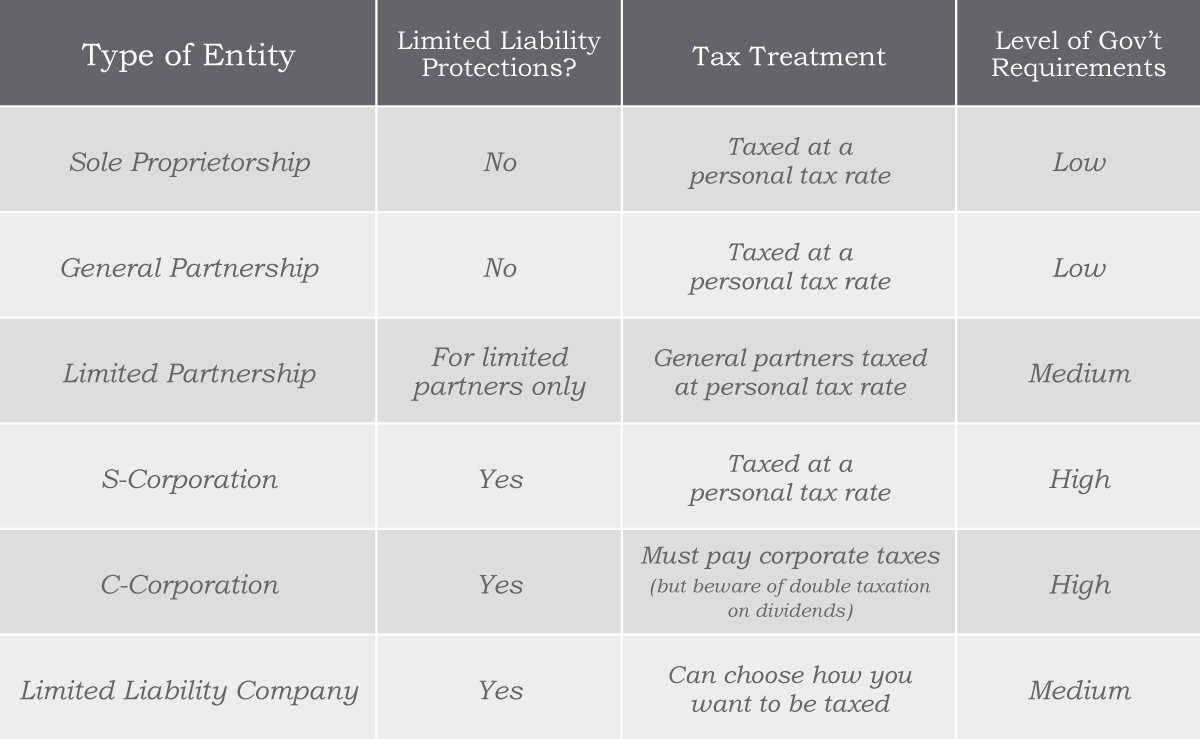

When determining which business form best suits the needs of the owners, many factors need to be considered. These include both tax and nontax factors. The goal in choosing a business form is to structure it such that the form meets the taxpayer’s nontax objectives, while maximizing any current and future tax benefits.

Liability protection, tax reporting, and government compliance are all key pillars of your business foundation. California Accounting can help make sure these pillars are strategically aligned with the needs of your business and its owners. With a solid foundation, you and your business will be able to focus on the operations of the industry you know inside-and-out. Leave the taxes to us!

Give our Tax Experts a call today at 916.721.4357.

California Accounting would be pleased to get in touch to discuss your accounting and tax needs.

By submitting this form and signing up for texts, you consent to receive text messages from CaAccounting at the number provided. Msg data rates may apply. You can opt-out at any time.

Monday - Friday

9:00am - 5:00pm

Closed on Holidays